Document System Overhaul for a Leading Lloyd’s Broker: Enhancing Efficiency & Security in the Insurance Sector

Are outdated document systems costing your business time and money? Learn how one Lloyd’s Broker streamlined their operations by partnering with Tier 2 Consulting to modernise their systems for greater efficiency.

In this case study, we highlight a significant past project with Croton Stokes Wilson Holden Ltd. (now part of Tysers since 2019). This period marked rapid changes in the insurance industry, with developments in web technology enabling more professional and cost-effective operations, benefiting underwriters, brokers, and insurers alike.

Struggling with inefficient document systems? Tier 2’s custom solutions can transform your operations.

Disclaimer: This case study originally dates back to 2012. We are sharing it again to highlight key insights and solutions that remain relevant today. Please note that some information, technology, and strategies discussed in the case study may have evolved since its original publication.

In recent years, the insurance industry has seen a number of significant changes in terms of the amount of technical information required by underwriters. Developments in web technology have allowed the industry as a whole to operate on a more professional and cost effective basis that has led to many benefits for underwriters, brokers and insurers.

The team here at Tier 2 has been working closely with independent Lloyd’s Broker, Croton Stokes and Wilson Ltd. to ensure it stays competitive against some of the larger brokers, by modernising its technology and systems, maintain its strong position in the industry and to build on its reputation with both underwriters and clients.

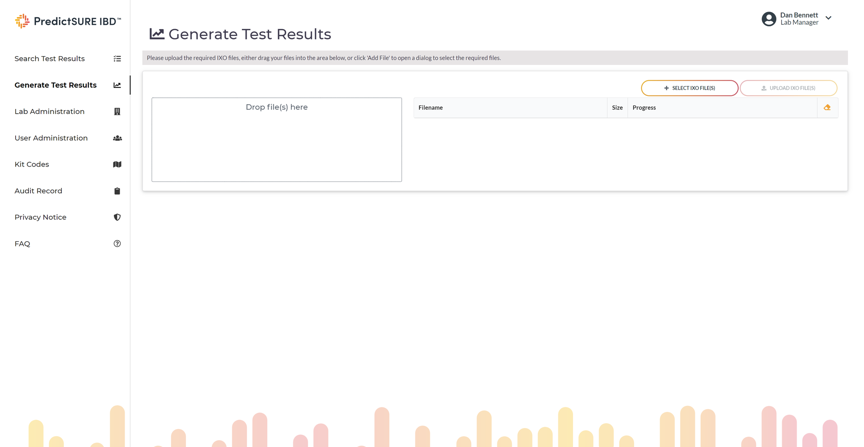

Implementing our ARENA framework, we have created a document control system that produces any form of electronic documents including compliance information, placing slips and aggregate reports, available to underwriters within a secure, searchable, online environment.

Les Doel, Technical Manager at Croton Stokes Wilson said,

“Prior to working on our new systems with Tier 2, we employed one member of staff almost exclusively to email statistical information to Underwriters, and were almost continually having to deal with requests to resend documents that had been lost, deleted in error, or uploaded and corrupted. This was a massive strain on our time and resources and, as the company grew, the problems increased.”

“With our new ARENA system, we are able to make the information available to underwriters in less than half the time and are free of requests for copies because, once loaded on to ARENA, the documents are available until we archive them. Furthermore, the security permissions that are automatically built into the system make this a safer means of dispatch which is ideal when dealing with confidential insurance information.”

Our Managing Director, Andy Kennedy comments:

“While ARENA was initially developed to support pharmaceuticals document control requirements, this implementation again demonstrates its ability to provide benefit across industry sectors. Key to the success at Croton Stokes Wilson is our flexible pricing policy, meaning that advanced, distributed document control capabilities are comfortable within reach of organisations of any size.”

Struggling with inefficient document systems? Tier 2’s expert project delivery ensures seamless implementation to transform your operations.

How Can Tier 2 Help Your Insurance Business?

At Tier 2, we leverage our extensive experience in delivering custom solutions to the insurance sector, including the London insurance market. We’ve partnered with industry leaders like Ed Broking (now The Ardonagh Group), a French multinational insurance corporation, and a global provider of reinsurance and insurance-based risk solutions, among others.

Our expertise covers a range of projects, including document assembly, claims notification, performance tuning, and algorithmic underwriting. We support organisations in the adoption of digital contracts at three key stages of the placement process:

- Data Capture/Submission Stage: Using generative AI, we ingest information from PDFs including Slips, Bordereaux and Schedules of Values.

- Trading/Quotation Stage: We integrate with digital and algorithmic underwriting platforms to enhance speed, accuracy, and consistency of the underwriting process.

- Binding Stage: We automate the generation of contract documents (e.g., Evidence of Cover) for distribution and digital signing.

By leveraging AI data ingestion, submit-quote-buy processing engines, and algorithmic underwriting, Tier 2 Consulting enables the modernisation of insurance workflows, enhancing efficiency and accuracy across the board.

Ready to drive greater efficiency in your insurance operations?