Ed Broking – Digital Transformation in action

Traded platform recognised as ‘broking initiative of the year’ at The Insurance Insider Honours

Ed Broking LLP and Tier 2 Consulting have created TradEd, a revolutionary digital platform for the broking industry that’s enabling change across the globe. The goal of the project was to use digital efficiencies that drive down intermediary costs, whilst increasing trading intelligence at every stage of the process. The platform has since attracted interest from insurance and reinsurance networks looking for data-driven partnerships. In fact, last month it achieved status as ‘Broking Initiative of the Year’! To celebrate its success, this week, we look back on this challenging but ultimately successful project – it’s one that we’re particularly proud of.

Digital transformation in action for Ed Broking LLP: TradEd – The Broker Platform

Ed Broking LLP (our client) is a global wholesale insurance and reinsurance broker with offices in the world’s key regional and global insurance centres, that employs more than 450 people globally. With an annual traded risk revenue of approximately £1 billion, Ed Broking LLP (Ed) is one of Lloyd’s top 10 insurance brokers. The Tier 2 project became part of the wider change management initiatives that the company were introducing at the time.

“In October 2016 we had an idea that we should build a system that would revolutionise the way we work, and hopefully drive significant change within our industry.”

Jonathan Prinn

Group Head of Broking, Ed Broking LLP

At the time, Ed legacy processes were offline, non-digital and offered no data capture of meaningful reporting associated with live workflows. The motivations behind adopting a new broking platform were digital transformation and data efficiency. After brainstorming and shaping the platform-to-be’s operational requirements, it was decided that the best, most streamlined solution would be a modern and effective web-based broking platform. This required an online platform, that provided data capture and reported on live workflows.

Binding documentation lies at the heart of any brokered risk transaction, so project scoping also highlighted the need for the creation of ’contract class’ documents delivered via the Exari® DocGen™ document generation technology. Exari® has a significant footprint in the global insurance markets and this particular technology is used by multiple Lloyds brokers and underwriters. Therefore, integration of this DocGen™ technology needed to incorporate all the necessary document controls, data capture, process flow, back-office / third-party integrations and reporting functionality that the technology currently provided.

The core specifications of the platform-to-be were digital capture of data-rich information whilst delivering deployment at pace and against evolving requirements. Through close teamwork between Tier 2 Consulting, the internal IT department at Ed and Exari®, the build schedule for the platform development was achieved using agile software development methodologies and is now a project all parties are incredibly proud of.

“Looking back, to define that, build and deliver a significant part of that, in seven months, is an extraordinary achievement by anyone’s standards.”

Jonathan Prinn

Group Head of Broking, Ed Broking LLP

TradEd : The Broker Platform

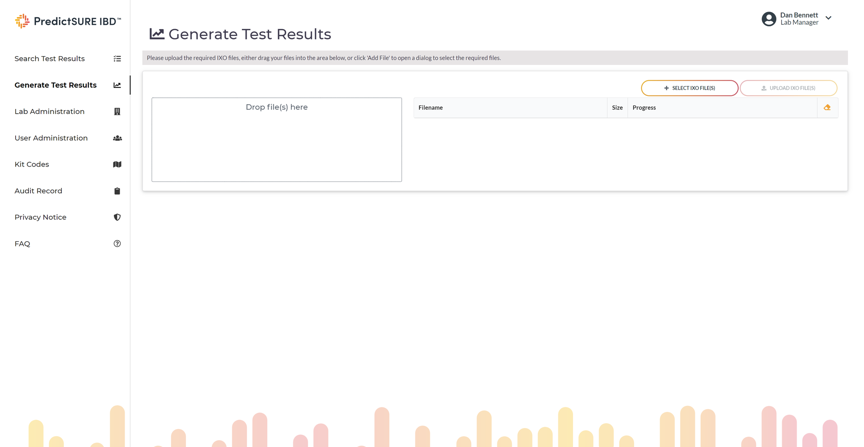

Launched into Ed London operations in July 2017, TradEd is now being used by brokers globally. It’s a web-based workflow application with mobile capabilities, designed to facilitate the entire risk placing process. But how does it achieve this?

Tier 2 and Ed IT team ensured that TradEd would use secure data capture linked to internal databases and 3rd party applications for market networks and business intelligence reporting. Working in the traditional manner of the Lloyd’s markets, brokers still visit underwriters on the Lloyd’s trading floor to discuss options. Now, they carry mobile devices with the TradEd application to update their carrier positions. The process facilitated by the platform is summarised below:

- Data around new risks is identified and captured by a broker

- Underwriters place risk with one or more carriers

- Data captured on mobile devices updates the back-end data tables and manages the integrity of the trade at each stage

- Compliance-related documents and sign-off stamps produced as trade is finalised

“The creation of the TradEd platform is the culmination of clear vision, strategic direction being actioned and great team work with Tier 2 Consulting.”

Jonathan Prinn

Group Head of Broking, Ed Broking LLP

Ease of use

The simplicity of the front-end screens used by the brokers moving through the process of placing a risk belies the complexity of the functionality happening in the back end of the application. The menu-driven nature of the user interface (UI) is also consistent across desktop and mobile devices. Brokers are walked through the process with form fields using pre-populated choices across multiple selections – from line of business (marine, energy etc) and carrier information (location, percentage of risk they are looking to underwrite) to document generation checks and approvals. It’s this ease of use that makes the app so appealing.

Complete compliance

The application embeds Exari® DocGen™ – the software which creates the binding risk documentation, based on interview style templates. This helps to create the audit trail around the various compliance procedures.

A first for the industry

Ed Broking LLP was the first Lloyd’s intermediary to use mobile devices to capture the outcomes from conversations taking place on the trading floor, specific to each risk. This collaboration between Ed and Tier 2 has created a revolutionary web-based trading platform generating ‘live touch’ reporting. No other financial intermediary has the functionality necessary to extract, transpose and load brokered risk data in this way.

As a result, Ed is now working with business intelligence dashboards refreshed every two hours, generating commercially valuable market insights for Ed and their trading partners, delivering another ‘first’ for the industry. This is digital transformation in action, made possible by the creation of TradEd, built by Tier 2 Consulting.

“TradEd has made a real tangible difference to the ProEx team, giving us brokers the ability to update risks and capture placement progress in real time whilst out in the market. In addition to the benefit it provides us brokers, it has also significantly improved the speed and efficiency which our back up team are able to process and issue our policy documentation.” Neal Hughes Divisional Director Professional and Executive Risk “

Neal Hughes

Divisional Director, Executive Risk

Tier 2 consulting help clients create custom software for web, mobile and enterprise applications that solve complex IT challenges, often around enterprise integration. If you’re looking to deliver a project requiring full-stack java developers, middleware consultants and Red Hat JBoss and Red Hat OpenShift experts – contact Tier 2 today.